Cash Management

Advisors have historically had many tasks that were required to be completed manually and many firms are still mired in this manual bog due to being stuck in legacy technology solutions. SMArtX helps to mitigate the number of manual processes by automating systems and our cash management application is a core application within the overall framework of SMArtX’s managed accounts technology architecture.

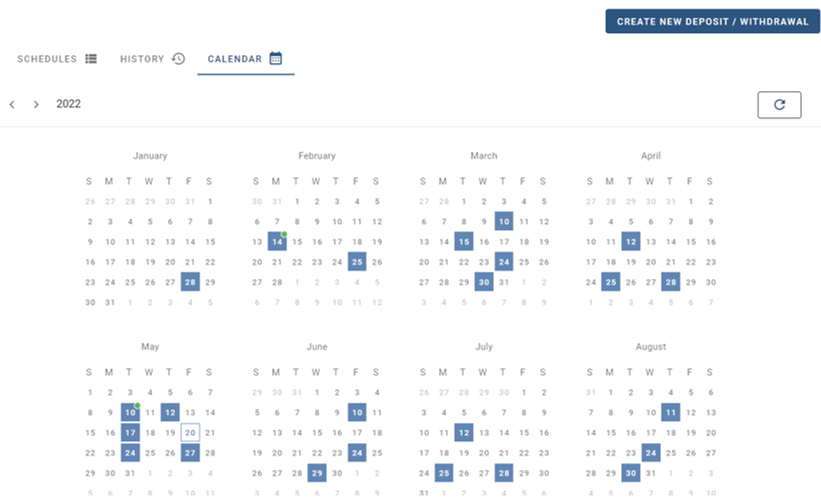

By calendarizing a client’s withdrawals and required distributions well out into the future on a preset basis, advisors no longer have to worry if their clients are receiving their cash in a desired timeframe. The withdrawal time frames and parameters can be adjusted at any time and the application effectively automates this task across all preset client accounts.

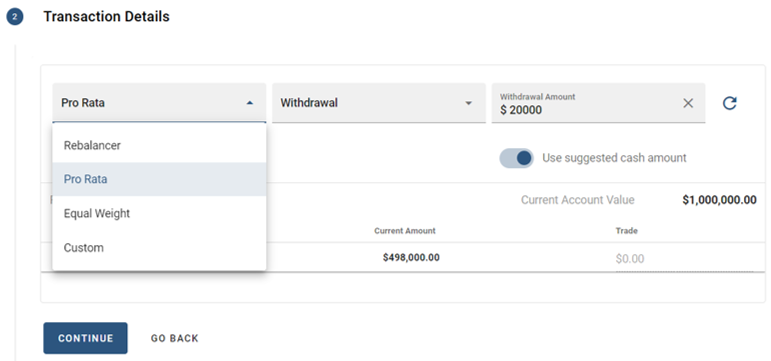

The cash management application can also oversee client additions. Deposits are dollar cost averaged and applied to the client accounts in a pre-determined methodology as they are afforded the same options as withdrawals. These include pro rata, rebalancer, equally weighted, of a custom parameter. This automation virtually eliminates the occurrences of “cash drag”, which can happen when a client wires money into their brokerage account, and it goes unnoticed by an advisor for a period of time.